Stellantis has invested €50 million in Vulcan Energy Resources and becomes the second-largest shareholder in the German-Austrian lithium producer.

Stellantis has become the second-largest stakeholder of Vulcan Energy Resources by investing €50 million in the German-Austrian lithium producer. The off-take deal for lithium hydroxide between Vulcan and Stellantis has been extended to ten years.

The Stellantis group has announced on “EV Day” in July 2021 that they will turn to lithium from geothermal production. After that, in November 2021, the company placed a binding order for up to 99,000 tones of lithium hydroxide over five years from Vulcan. The order is conditional to the beginning of commercial manufacture at Vulcan and full product qualification.

The separate announcements by Vulcan and Stellantis have not cleared the air about whether Stellantis still has above reservations or not. However, the statements by Stellantis CEO Carlos Tavares showed that the company’s rationale is the same as when the off-take deal was agreed on: “Making this highly strategic investment in a leading lithium company will help us create a resilient and sustainable value chain for our European electric vehicle battery production.”

According to Stellantis, the investment will be utilized for the “drilling project to expand Vulcan’s production capacity at its site in the Upper Rhine Valley”. Vulcan’s managing director Francis Wedin declared that the major investment by Stellantis in Vulcan and the Zero Carbon Lithium Project shows a strong statement by one of the world’s largest car manufacturers regarding sustainable and strategic sourcing of battery materials. He also stated that “Vulcan is fully aligned with decarbonization and electrification goals of Stellantis, which represent some of the most ambitious in the industry. It is encouraging to see a leading automaker investing in local, low carbon lithium production for electric vehicles.”

The two companies have also extended the binding off-take agreement for the lithium hydroxide by five years to 2035. However, new delivery quantities are not mentioned in the notices. Thus, it is open whether the previous purchase volume of 81,000 to 99,000 tones will also double like the term.

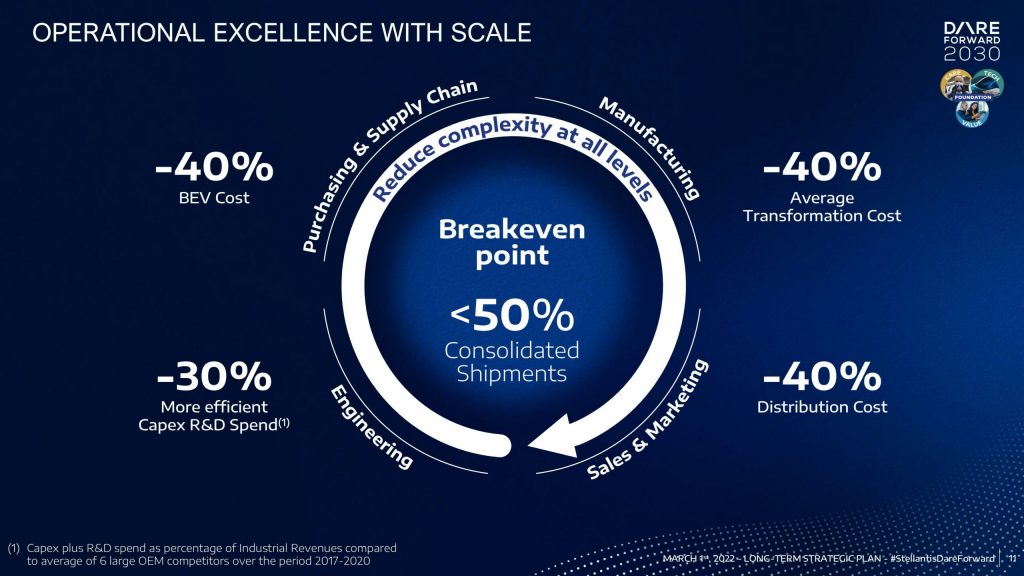

Stellantis has also announced its plans to reach 100% of passenger car battery electric vehicle (BEV) sales mix in Europe and 50% of passenger car and light-duty truck BEV sales mix in the United States by 2030 in the light of the Dare Forward 2030 strategic plan. Stellantis will be the industry champion in climate change mitigation, becoming carbon net-zero by 2038, with a 50% reduction by 2030.